Car Finance

Our car finance options are designed to offer you the flexibility and support you need, with competitive rates and tailored terms that suit your needs.

Our car finance options are designed to offer you the flexibility and support you need, with competitive rates and tailored terms that suit your needs.

Car finance involves borrowing money to purchase a vehicle, then repaying the loan in monthly installments. It can include various options like hire purchase, personal contract purchase, or leasing.

Our car finance options are designed to offer you the flexibility and support you need, with competitive rates and tailored terms that suit your needs.

Forget the endless paperwork and the frustrating waits

At Fast Funding 4U, you get quick approvals and expert support to guide you through the process. Our platform ensures you find the best financing option without the usual stress, so you can focus on what truly matters.

With just a few quick details, you can access multiple car finance offers tailored to your needs. Our streamlined system ensures you get preliminary approval in minutes, allowing you to focus on what matters most – running your business.

No lengthy paperwork, no endless waiting. Just fast, efficient financing solutions to get you on the road.

Apply now and see how easy car finance can be with Fast Funding 4U.

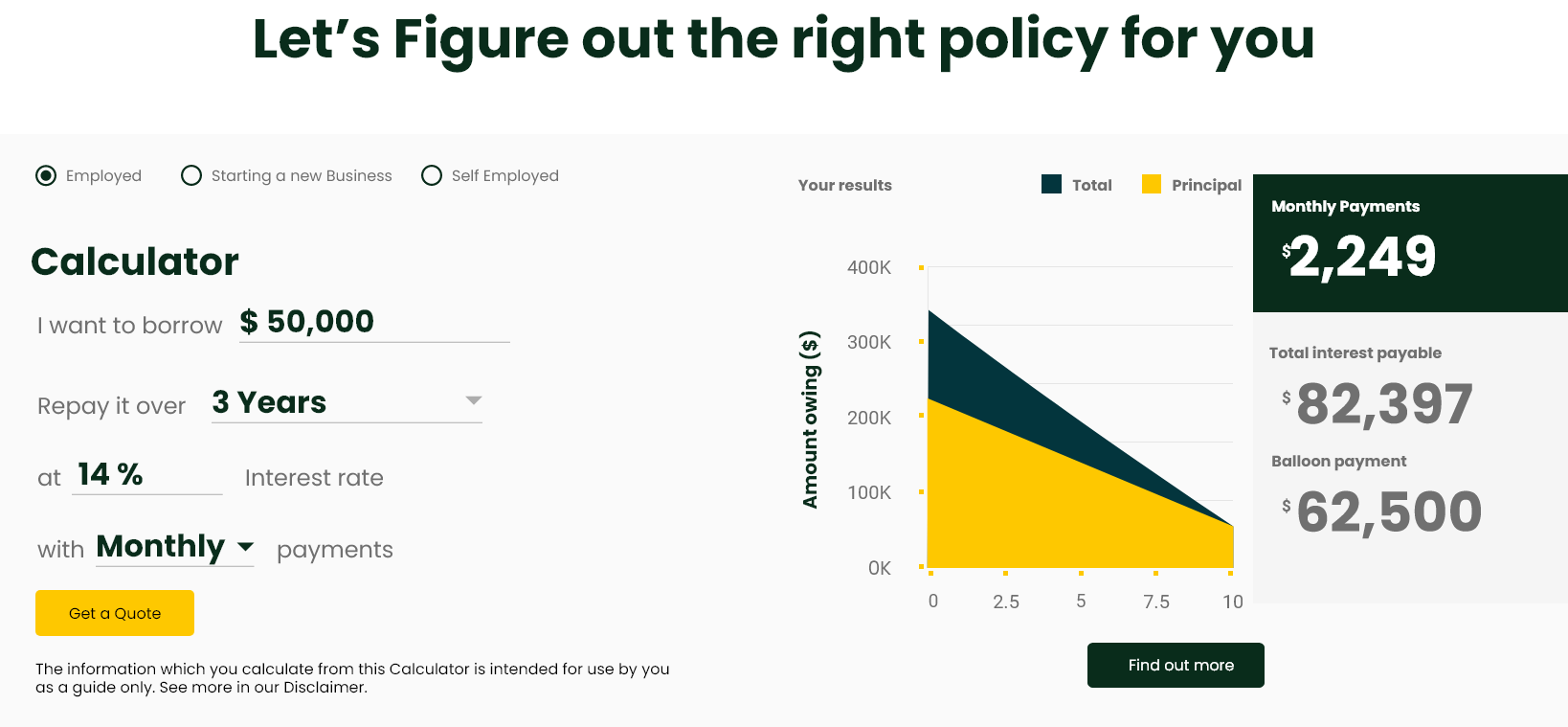

Yes, financing options are available for those with bad credit. Our network includes lenders who specialise in providing solutions for various credit profiles. While interest rates might be higher, our platform aims to find the most competitive rates possible. Factors such as collateral, and a co-signer can improve your chances of approval. By using our calculator, you can see what options are available based on your specific circumstances. Our team is also available to provide advice and support to improve your credit profile for future financing opportunities.

Repayment terms vary by lender and loan type, typically ranging from 12 months to 7 years. The terms depend on the amount borrowed, the type of asset financed, and your financial profile. Our calculator provides detailed information on repayment schedules, helping you choose the best fit for your needs. Flexible repayment options allow you to select a term that aligns with your cash flow and financial planning. Understanding the repayment terms is crucial for managing your finances effectively and avoiding any surprises down the line. Contact our team for more detailed information tailored to your situation.

With over 25 years of experience, we’ve got the knowledge you need on your side.

Our online processes mean you don’t need to leave the comfort of your own home.

Real people, real service. We’re here for you and will keep you informed at every step.